Will Energy Firms Fail This Winter?

As the UK is left reeling from the recent spate of energy firm collapses, analysts are predicting we’re not over the worst of it yet. With the seasonal winter 2018 demand pushing prices up on one side and the energy price cap squeezing profits on another, could we see more bankrupt suppliers before the financial year is over?

The analysts are predicting that up to 10 more energy firms could fail before the winter season is out. Those who survive the cold weather cull should live to fight another financial year, but for many it’s a tough time to be in the energy supply business .

A ‘cash intensive market’

The failure of numerous energy firms over the last 12 months has caused many to question what’s fundamentally wrong with the UK’s energy industry. Analysts at Baringa Partners say it’s just a question of economics.

Their Energy Analyst, Ellen Fraser, spoke to the BBC last week, saying,

"It is a very cash intensive market," she said, pointing out that energy is bought upfront with the money from customer bills coming in later. Some did not understand that dynamic."

While it’s true that energy costs must be absorbed up front, to say that it was misunderstood must be a mistake. Any company entering the energy marketplace must have a grasp on how the industry works, otherwise why would they be going into business?

Chances are that the real lynchpin came in the shape of unexpected changes in the economic environment. With the seasonal rising costs of wholesale gas and electricity being compounded by a general increase in prices, many suppliers wouldn’t have expected to be outlying quite the amount they’re being expected to right now.

Add to this the shifting goalposts created by the newly introduced energy price cap, and suddenly some businesses become unviable.

A shrinking marketplace

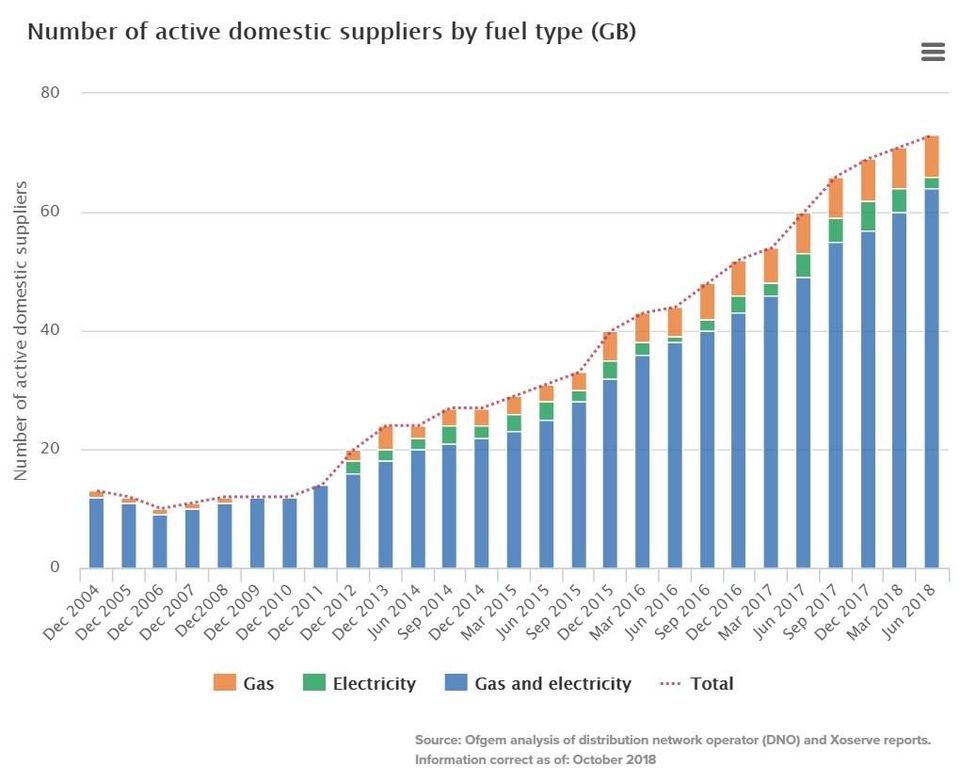

At its peak, the UK energy supply market boasted around 70 different suppliers. These included, of course, the big six, and numerous challenger companies looking to secure their share of the industry. As of January this year, that number has fallen to just 60.

However, many of these challenger suppliers have been very recent additions to the UK marketplace. Ten years ago, there were just 12 options for gas and electricity supply, a number that has been exponentially growing over the past few years.Some suppliers have been accused of irresponsible levels of under-pricing, launching cut price deals in order to reach the top of the price comparison tables. Such strategies are unsustainable, leading to eventual failure of the firm.

Customers of failed energy suppliers have their credit balances protected under Ofgem’s safety net, but this money has to be paid back to the appointed ‘supplier of last resort’. As such, the cost of collapsed energy firms is estimated to be costing the UK bill payer around £80m as a result.

Clearly, if energy companies are going to not just survive but thrive in the current economic climate, a sustainable pricing structure needs to be adopted. Perhaps, as customers become more weary of doing business with the very cheapest suppliers, more emphasis will be placed on quality customer service and a track record of success, leading to a healthier industry overall.